AI Opportunity In Ad Tech; What A Holdco Needs; Zuck's Empty Threats

What Is The AI Opportunity In Ad Tech

Ad tech (US mainly) is gushing at this latest ad tech AI landscape box fest dominating the LinkedIn feed. The industry is literally being foie gras’d this AI narrative because it's zeitgeisty, and the vibes feel good.

When you strip away all the noise, it's worth repeating that we (ad tech) are in the mousetrap business.

If AI automates some of that process - planning, trading, creative, and measurement - that would be great. However, a lot of this AI ad tech becomes commoditised very quickly.

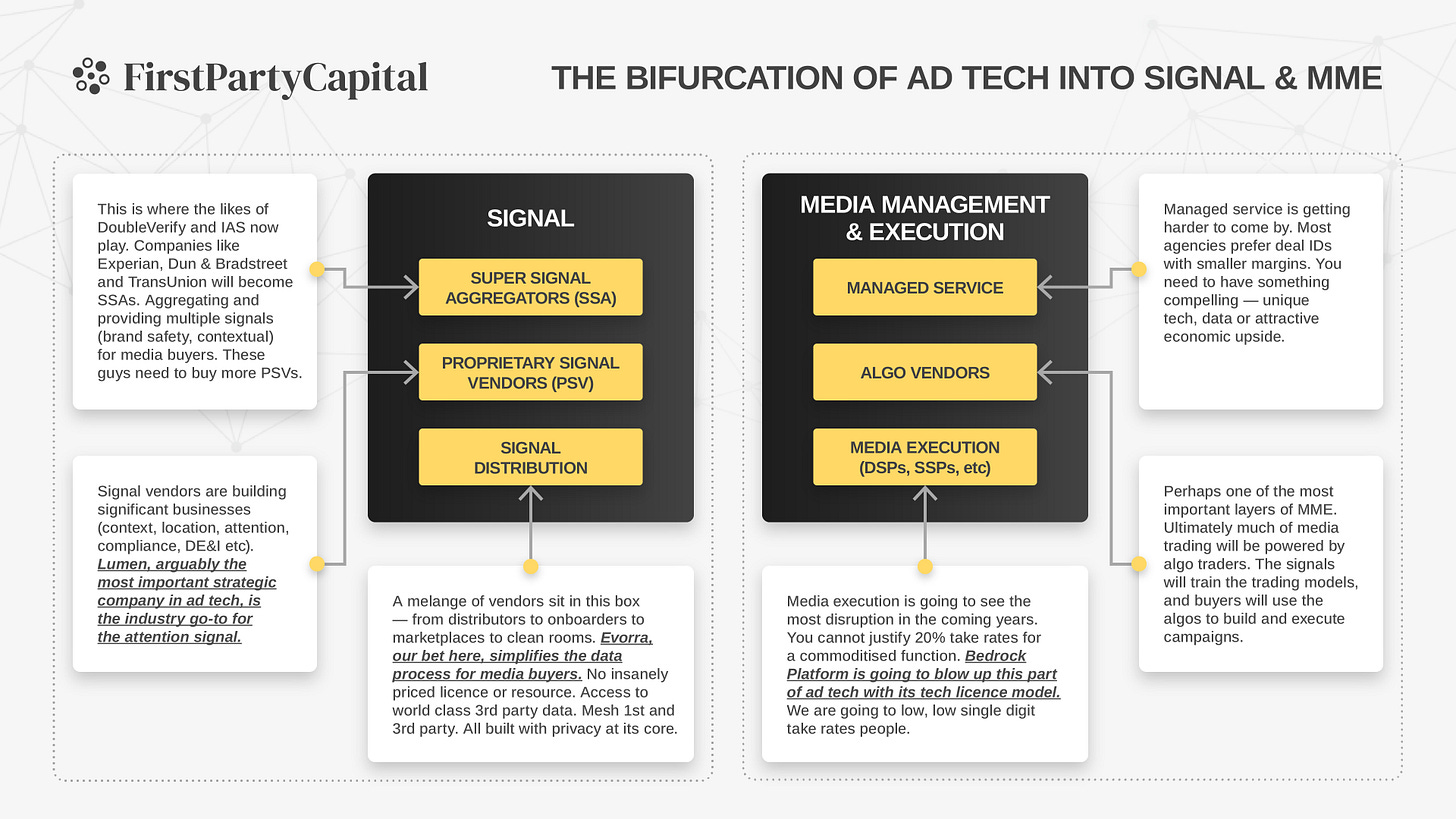

The only differentiator will be the proprietary data training of these models, which is why SSAs (Super Signal Aggregations) are best placed to build PMAX or Advantage+ type stacks for the open web.

FPC is not a fan of scapes - or any kind of scaping. You are in proper trouble if you need a box to justify your existence and can’t make any money.

But just to contradict ourselves completely, we sketched out a post-Lumascape ecosystem a few months ago, illustrating the bifurcation of media and data (see below). It ignores the creative and measurement piece (we will address that again).

It’s tough to synthesise all the noise from blogs, posts, and podcasts to create a coherent understanding of how AI might affect ad tech in the near term.

To help, we have compiled a handy ad tech AI BS survival guide to navigate the current madness:

There is a fallacy that legacy ad tech is not using AI to improve or evolve its solutions. It is. There is no dual track in ad tech: legacy versus AI. Don’t believe the hype.

Of course, AI-powered ad tech will exist, but it will unlikely survive as a standalone AI point solution (long-term, no defensibility). We are incubating a company with AI at the core, but it is very much a media business. It will make money. In short, AI needs to be powering a sustainable business model.

SSAs (Super Signal Aggregator) are well placed to emulate the scaled AI-powered ad campaign automation successfully pushed by Google and Meta. There will be five or six scaled plays.

The SSA playbook is signals + custom algorithm + activation + measurement.

AI + proprietary data is the killer combo. Unique proprietary powering a model will be a go-to for campaign activation. This is why PSVs (Proprietary Signal Vendors) will be in significant demand as SSAs look to differentiate.

You can have all the AI capability, but you're dead if you have no agency/brand demand. Ad tech Rule 101. Same as it ever was.

Finally, it's okay to disagree with and question the “experts.” You won't look stupid; you'll be way more nuanced than the lad giddily running with the herd.

Please post your angry ChatGPT-powered responses with rocket ship emojis and tag us on LinkedIn. FPC promises not to reply.

What Holdcos Want From Ad Tech - Prop Data

This week's big news is that GroupM is rebranding as WPP Media. Well-known agency brands, EssenceMediacom, Mindshare and Wavemaker, are being folded into the new WPP Media. Everything is moving to one P&L.

This is a significant event for ad tech. It’ll probably become even more challenging to sell into WPP. But it has been coming for a while. Here are some thoughts on what this all means for our LPs and portfolio companies:

Managed service businesses will find accessing media budgets almost impossible. This is a similar situation to the other big groups. It will likely be curated deals all the way - run through DV360 and TTD. The number of companies working with WPP Media will be consolidated. Managed service will move to indies and in-house brands.

The picks and shovel strategy still works with hold cos: in TV for instance, portfolio company LightBoxTV is building the TV planning and activation layer for several hold co’s. Empowerment and control is attractive to margin-conscious agencies.

Proprietary data companies win this “shift to signal” at hold cos. Whether they power principal buying activities or via curated marketplaces, companies with proprietary data, like Lumen, Wult, and Picnic, will be in significant demand. The shift to signal is real.

Economics is going to become even more significant for big holdcos. Ad tech companies that can reduce take rates will win more business.

Curation will grow massively as agencies seek more control over supply chains. This will allow new companies (Chalice, Cognitiv and 59A) in the emerging areas like the algo trading category to prosper as agencies piece together their own SSA (Super Signal Aggregator) stack. Remember:

Some groups will build makeshift SSAs. Others may use an ad tech stack.

Emerging channels will get cut through. Areas like retail media, audio and social commerce are still nascent enough for hold co’s to look to partners.

On the AI front, most holdcos will likely build their own creative production and prompt-based planning solutions. There is no moat around stand-alone AI companies in ad tech. If you bundle it into a data product or optimisation solution, you will win out.

The Meta Hamster Wheel

This week, there was a mini panic about Mark Zuckerberg’s take on the future of advertising. Read The Verge’s take here: https://www.theverge.com/meta/659506/mark-zuckerberg-ai-facebook-ads.

In short, brand advertising is dead, and the Meta black box solution is your only choice going forward. You give Zuck money, and he’ll deliver all your LTV dreams - no questions asked. Hu-hum.

Meta uses AI the best way possible: optimising its ad stack, from creative production to outcomes.

But his utopian view of Meta serfdom, where brands get on the Meta hamster wheel in perpetuity (paying for effectively retargeting users), is pretty deluded.

If you want garbage UGC at scale, s*** human ennui signal, and a commoditised brand, Meta is for you. Pay the Zuck to compete against 1000s of other brands. Welcome to a race-to-the-bottom business.

Allocate your spend sensibly (spend less with Meta) if you wish to build brand equity, control costs, and have an attribution system that reflects the broader media ecosystem.

We have seen this narrative before. It sounds great to the Wall Street analysts, but it is the typical diatribe from a Silicon Valley CEO trying to flex. And it invariably ends with big, successful brands doing the opposite.

And on that insightful note, FPC will sign off for another week. Have a great ad tech day.