Calling All Ad Networks & Sales Houses; More Than A VC; Inertia Is Slowly Killing Our industry

Hi Sales Houses & Ad Networks, FPC Wants To Work With You

Last week we spoke about America, and its mind-boggling amounts of marketing spend. We even made a handy to-do list for those aspiring to break through.

The US is a big opportunity. But you cannot ignore the global market.

The problem with the ROW is that it's a complicated mess of markets, languages and business practices. Ad tech finds it difficult to make money outside the US. Some even run it as a loss to give clients global access.

The ad net is the only entity that consistently makes it work Despite this, ad tech seems to have abandoned the ad net. The last great company to embrace the ad net was AppNexus.

The only way to scale outside the US is to become an enabler, offering managed service providers the tools to make money. You might sacrifice some margin in the process but you get new revenue streams across aggregated markets.

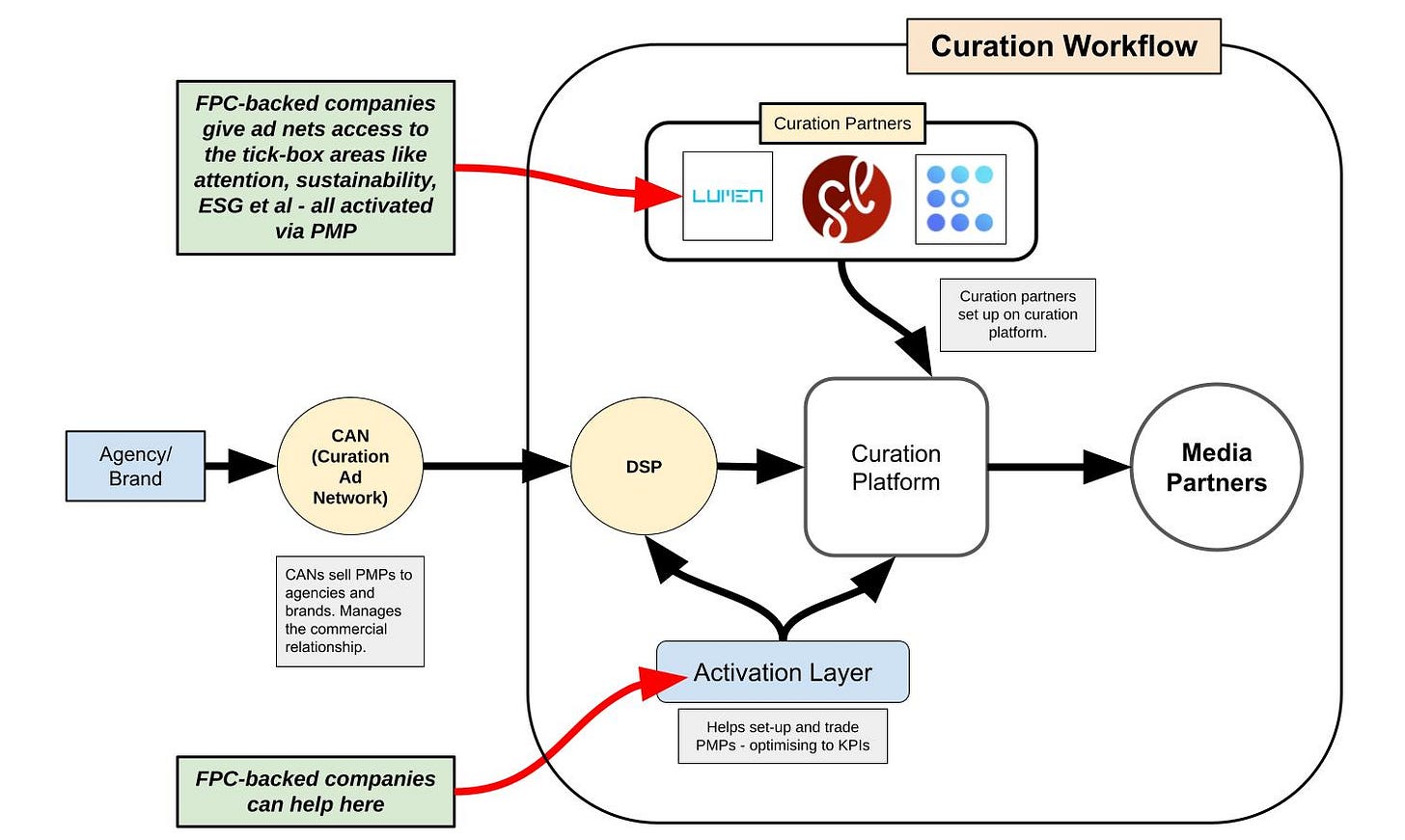

As part of our efforts to grow our companies, we are working with some partners to launch a new curation model.

We want to lean into the PMPs, making it viable for our portfolio companies to activate their amazing tech and data assets in media buys - but not trying to sell PMP deals to everyone.

The best parties to sell PMPs are ad networks. That’s why FPC wants to hear from its ad net and sales house readers (we want to work with you).

We are currently trialing the CAN (see overview below) with a number of beta partners in Europe, APAC and LATAM.

Just to clarify: we are not selling the tech, we are pushing the concept.

So, how does it benefit us? The curation workflow enables our portfolio companies get used in PMP deals across disparate markets, allowing them to grow in a more cost efficient way.

If you are interested in partnering on the Curation Ad network model, use the link below and fill out the form.

https://firstpartycapital.com/find-out-more-about-can/

More Than A VC, More Than A VC To Me

VC is going through a rocky phase right now. After a decade of excess in terms of frenzied unicorn and meme chasing, we now have funds aggressively marking down investments.

Big generalist funds are struggling to raise money - and some are wisely handing unallocated capital back to LPs.

Granted there’s been a last ditch attempt to recoup losses by going all in on AI. That will inevitably fail too given most are overpaying for commoditised OpenAI-powered dross.

Consolidation of that generalist layer is inevitable - as free cash dries up.

The opportunity in VC is in verticalisation, investing in areas where you as an investor have domain knowledge.

But even then, you will need to add more value than capital and aggressive spreadsheet bullying.

FPC takes an active role in helping our companies get from back-of-beer-mat stage to multi-million profit making ad tech machines.

Her’s how we redefine the notion of “smart money”:

Financial planning and strategy: It seems obvious. But founders struggle to manage burn and plan accordingly. This is one of our core offerings - and arguably the most important.

Product development: Ideas are plentiful. Execution is everything. Getting a product from idea to scale takes a lot of work. Thankfully we have experience and resources to achieve the objective of getting a market fit, growing, getting to profitability and exiting.

We understand the politics and economics of ad tech: So many ad tech startups die on this particular hill. Your product is important. But understanding how money flows is critical to business success. For instance, NOBODY has figured out a way to go “client direct” outside the US. Agencies give you the big budgets - end of. Understanding what they want is the key to growth. Cautionary tales abound (cc MediaMath). Knowing the system will help you win.

Helping scale globally: Last week we spoke at length about “breaking America”. You need a strategy for the rest of the world. Nobody really has one. We have many (see our first story). This makes us unique versus everyone else.

Product positioning: Ad tech is 60% tech and 40% bullshit (AKA storytelling). If your positioning is poor, you will get no cut through. The Americans are masters of this. The rest of us: not so good. FPC has deep experience in helping position and brand ad tech companies from early stage right through to the liquidity event.

Selling ad tech assets: This is a rare add-on - but needs must. FPC is acting as the sales agent for a portfolio company asset. Having sold two licenses to date, we have helped raise the guts of a million for one of our portfolio companies. Once again demonstrating the peerless polymathic abilities of the FPC fund.

If you're reading this and thinking, “wow, these guys sound like they know what they're doing”, then this is the time to act. We are still fundraising - and you can still be part of fund 1.

We want our newsletter readers to invest because they are clearly intelligent and engaged members of the ad tech community. There are over 3500 of you now. Why not get involved?

Express an interest, by filling in the form below:

https://firstpartycapital.com/seed-syndicate-form/

Time To Break Some Bad Habits

Despite all the chat about ad tech tech eating the media and marketing world, this business is very much still a people-first business.

Relationships and a robust professional network are core to success in this game. From startups, to the behemoth tech companies, to agencies, to media companies, this human connection matters.

You could argue that the post-covid work framework is chipping away at the industry’s core foundation.

Is “hybrid working” quietly breeding a corrosive form of business inertia? Even a hardened work-from-home advocate will concede that something important is getting lost in the never-ending chain of soulless Zoom chats.

You cannot beat IRL meetings. How do you get to know your colleagues or business partners? Not on google chat. And definitely not on a virtual call with 10 people.

In an era of technological and industry upheaval, now is not the time to sit at home in your t-shirt and puma tracksuit bottoms - procrastinating over whether you should walk to the local PRET for that stretch-your-legs 11am coffee.

You need to be out there. You need to meet people face-to-face, getting to grips on what’s happening now and what’s coming next.

And let’s not forget about those serendipitous moments that birth the next wave of companies and business models. You CANNOT recreate that on Slack or Teams.

We are certainly not advocating getting people back to a 5 day working week in the office. There is of course a happy medium.

But it’s more important than ever to recognise this creeping inertia - and act against it. Insist on breakfast and lunch meetings. See people in the real world. Schedule some drinks from time-to-time. Foster and cultivate your professional network.

And, finally, make sure you attend world-class industry events like ATS & MadTechMoney.. Be seen - get networking.

And on that preachy note, we will sign off for this edition of the FPC newsletter. Have a great weekend.