European MadTech M&A Smashes Through $5 Billion; Only 1 Day Before LightBox Deal Closes; More World-Class Speakers Added To The MadTechMoney Line-Up

5 Billion Reasons To Invest In European MadTech, And “Confirmation Bias” Ain’t One

We have been preaching the many reasons to invest in MadTech startups outside the US since launching this newsletter last November. Now we have 5 billion.

FirstPartyCapital has been tracking European exits since the start of 2021.

The combined exit value over the last year has just surpassed $5 billion. That includes IPOs, trade sales and private equity deals.

Here is a list of European MadTech exits over $100 million that happened over the last twelve months:

Iponweb

Profitero

ADYOULIKE

Clearcode

LoopMe

TVSquared

TapTap

MIQ (soon-to-be-announced)

Seedtag

1plusX

Celtra

Ad-lib.io

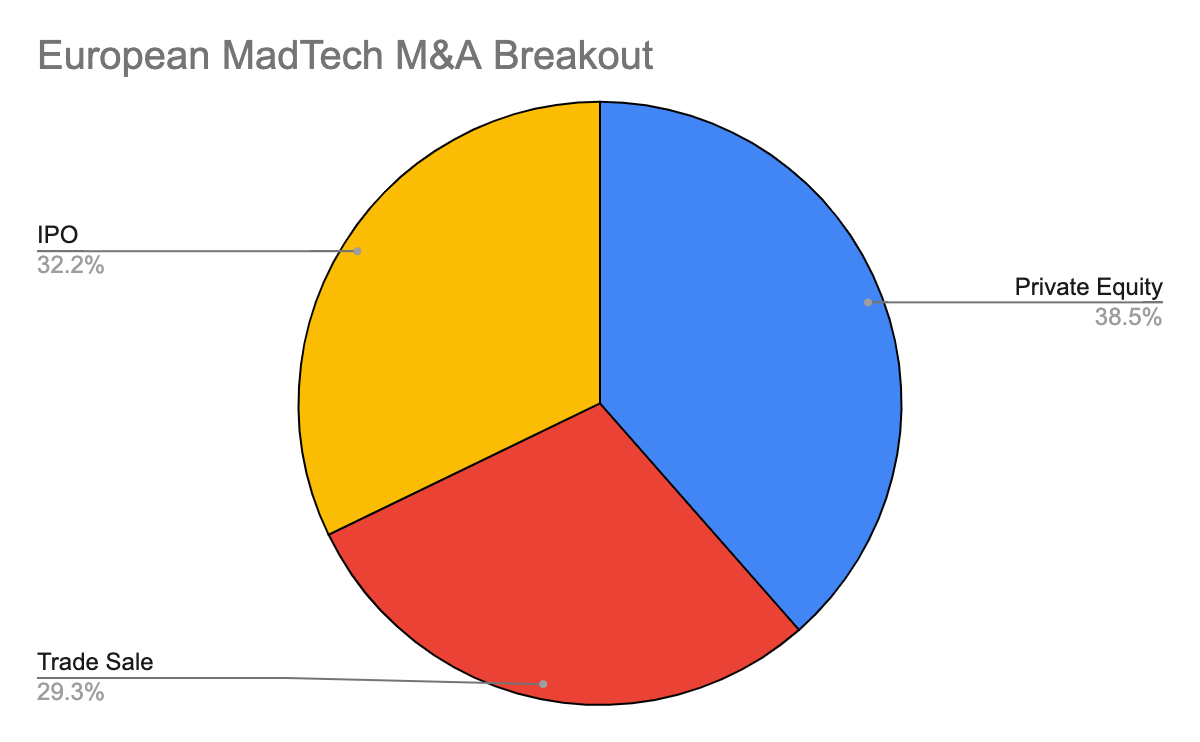

The chart below breaks out this $5 billion number into IPO, trade sale and PE deals.

For an early stage investor like FirstPartyCapital, this $5 billion data point is going to be a key go-to stat when raising money from LPs.

We continue to battle an ingrained “confirmation bias” from some in this industry who refuse to see any potential outside the US.

US exceptionalism continues to influence investment decisions. You can’t argue against the fact that the US has been innovation hub for martech and ad tech for the past two decades. And the biggest M&A deals are still US-based.

But the world is changing. We are excited to see startups outside the US building for a fragmented world instead of focusing on the monolithic US media market. FPC is investing heavily in privacy-first solutions attacking big problems in high growth verticals.

Some of those suffering from the aforementioned “confirmation bias” will doubtless push back on our narrative, pointing out that those companies listed above were sold in the US.

Our answer to this: we couldn’t care less, as we invest at seed and pre-seed.

It’s likely we would have invested in some of those listed above had FPC been actively investing over the past decade.

We will say this again: this industry is right at the start of a new innovation cycle that will cause a huge amount of disruption. There will never be a better time to invest, as legacy ad tech falls asunder.

We intend to capitalise the startups shaping the future of this industry, giving our savvy LP investors exceptional returns.

You still have time to invest in FPC, but the window for access to our Fund 1 raise is decreasing by the day.

How best to summarise this $5 billion number? In short: European MadTech FTW.

Only 1 Day Left Until LightBox Deal Closes

We have had the LightBox deal live on the FirstPartyCapital platform for nearly a month now. There has been huge interest in the deal - and we are going to be oversubscribed.

I expect you all know about LightBox - and how the solution aggregates and activates the fragmented TV market. If not, here’s a link with our summary on the founders, the tech and the big opportunity.

You can still invest by signing up here:

Only 24 hours left, readers. The clock is against you. Tick. Tick.

More World Class Speakers Added To MadTechMoney

As you know, we are hosting our first feature length event, MadTechMoney, on October 11.

Our objective with MadTechMoney: bring together ad tech/martech founders and the investment community (private equity, venture capital, corporate development and strategic investors) to help foster discussion and networking between madtech and money.

We already have a star-studded line-up of speakers from across the eco-system. Details on can be seen on our event website.

Here is a sample of agenda items for the half-day event:

Early stage investment: from beer mat to MVP.

MadTech scale: how to grow your tech business globally.

The big exit… Trade sale, PE or IPO?

The corp dev view… What are strategic buyers looking for?

Just to re-iterate: MadTechMoney is not a trade conference and it will not focus on industry trends. It’s about money.

And if you are confused as to whether you should attend, here is a list of those coming to MadTechMoney:

MadTech founders (early stage, growth stage and late stage companies).

Private equity.

Venture capital (early stage, growth stage and late stage).

Angel investors.

Corporate development.

M&A bankers and advisors.

More details on speakers and panels will be published in the coming weeks.

Tickets are limited and are selling fast.