The Atomisation Of Ad Tech; Farewell To Our Friend John; Evorra Raise & Podcast

The Atomisation Of Ad Tech

The Lumascape has been a go-to resource for understanding ad tech's ever-evolving mess of companies for over a decade. Terry Kawaja and co literally boxed off the ad tech ecosystem to help us all navigate the mayhem.

And it worked. Vendors defined themselves by where they sat on the industry’s most famous scape. They all clamoured to be listed.

You lived and died by having your logo in the latest M&A “hot” box. Some companies even had their unique customised square. A lot of ad tech M&A strategy was built around the Lumacsape when it was much easier to compartmentalise companies.

Times have changed, though. Defining a buy-side, sell-side, media or data company is challenging. Everything is collapsing in on itself. Whether SPO, buy-side curation, or sell-side curation, everything is bleeding into one.

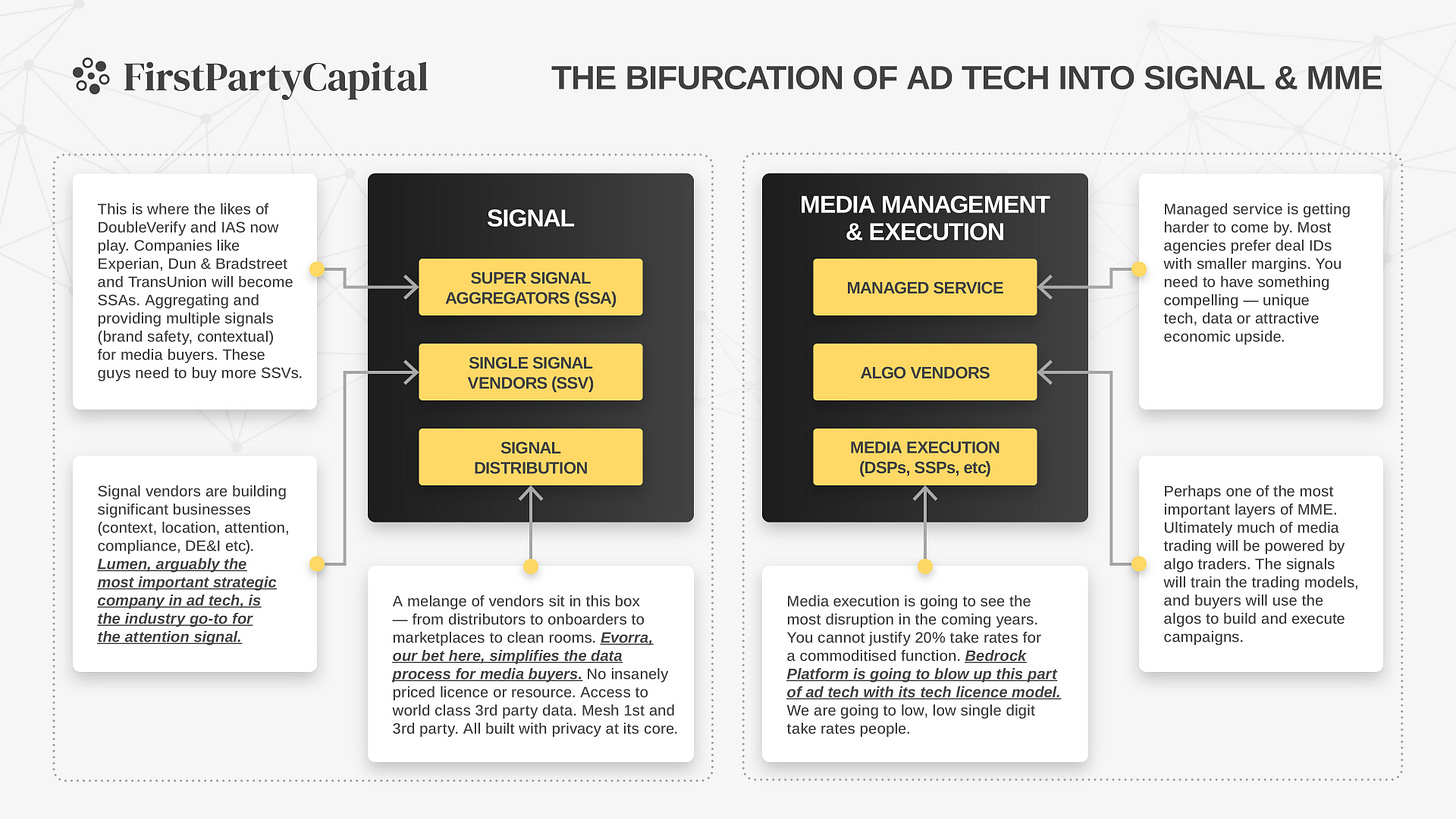

FPC took a stab at defining the new-look ecosystem (see below). The signal is now critical. Proprietary signals define your value in the space. SSA (Super Signal Aggregators) will acquire more proprietary signal companies. That’s a given.

But this alone will not be enough for scaling revenue. Increasingly, companies like DoubleVerify and Experian are merging the signal and activation.

The Audigent deal allows Experian to get closer to the money. Having Audigent working with agencies and brands to activate Experian signal will doubtless juice revenue.

DV took it one step further when it acquired Scibids, enabling it to train the trading algo with prop data. You can see how cos like 59A and Chalice fit nicely into Experian or another SSA.

The final piece is measurement. The outcome becomes the ultimate goal and the means to accelerate growth. As you scale, an O&O measurement layer becomes almost a requisite. Marking your homework helps you secure bigger budgets. It works for Meta, Google and Amazon.

The signal becomes even more critical here for measurement and programmatic activation.

The Lumascape was seminal. But maybe it’s time to revise it so we can properly articulate the new chaotic ad tech landscape.

Farewell To FPC LP & Friend, John Danby

We said goodbye to John Danby, an industry legend, this week. He tragically passed away over the Christmas period.

John has been a fixture of the European ad tech space for over two decades. He was a dedicated student of the ad tech game and a fierce competitor. FPC has never seen any industry person get so animated on prospecting versus retargeting.

Professionally, he made his name helping grow MIQ (a criminally overlooked company and second only, in FPC’s mind, to TTD in GOAT status) from a small programmatic ad net to an ad tech powerhouse.

Lee Puri and Gurman Hundal founded one of the great ad tech companies, and their lieutenants - like John, Joe Worswick, and Paul Silver - pushed MIQ to the upper echelons of ad tech greatness. John was a commercial animal, deeply understanding the nuances of agency politics and economics.

For any company to scale like MIQ, you must know how to negotiate a trade deal. John was a master.

On a personal level, John was one of the good people in the industry. He was always up for a good-spirited debate, whether industry-related or political. And he was always full of decency, banter, and good cheer.

It's shocking that he’s gone. He had much more to give, and the industry will miss him.

FPC salutes you, sir. Go raibh suaimhneas síoraí air.

Evorra Syndicate Raise

Evorra has made significant progress over the past six months, finding product market fit and signing new clients.

The helicopter overview of Evorra for those readers, not au fait with the company: a data tech layer that enables indie agencies to segment and activate first-party and third-party data across wall gardens and the open web. It makes it affordable to run data campaigns and acts as a distribution point for big data players.

Evorra CEO Aaron Ritoper joined us on The FPC Podcast this week to discuss its progress and upcoming FPC syndicate round. Yes, reader, you can still get in at a decent valuation before its series A at the end of the year.

You can listen to the podcast in full here: https://newsletter.firstpartycapital.com/p/episode-8-q-and-a-with-evorras-ceo.

We will share details on how to participate in the coming weeks. If you want to register interest, send an email to contact@firstpartycapital.com.

This is the first newsletter we have done in a while. Now that LinkedIn has degenerated into a flag-waving tech bro jingoistic pile of Elon Musk content porn, we want to push more content out on the newsletter. It is a much more civilised way to communicate.

We will return to the weekly schedule so readers can enjoy world-class propaganda and helpful insight.