The FPC Newsletter Is Back; European Deal Activity 2022 In Review; And Google In A Proper Bind

Wait. Who Are You? And What Have You Done With My Weekly Newsletter?

It’s been quite a while since we put out an edition of the FPC newsletter (Dec 2 of last year to be exact). Why the long break? What have we been doing with our time?

FPC has been heads-down busy fundraising for the past two months - and this hard graft is starting to pay off. Just this week we secured over $2 million in corporate investment, getting us within touching distance of our $10 million target.

The fund portfolio will have 20 investments by the end of the year - with a bunch in great shape to raise seed and series A rounds in late 2023 and early 2024. Our latest investor deck can be viewed here: https://docsend.com/view/rfqih8kc9htmdqhv.

We will be closing fund 1 off to external investors at the end of this quarter. If you are interested in investing or topping-up, now is the time to act. Get in touch to get in before the close: contact@firstpartycapital.com.

The good news about our recent successful bout of fundraising is that the FPC newsletter is returning to its regular weekly spot on a Friday morning. Onwards.

2022 MadTech Deal Activity In Europe (Brief) Review

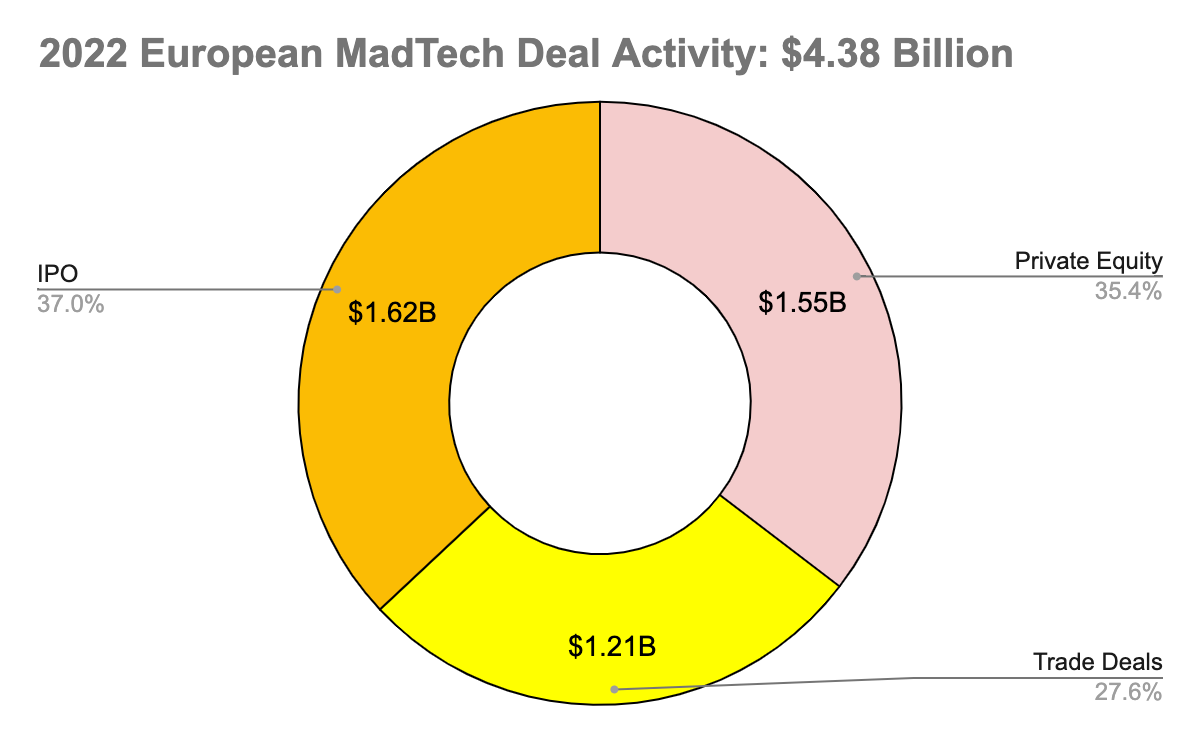

2022 was a good year for MadTech deals in Europe - with over $4 billion transactions completed over the past 12 months.

Who knows what 2023 will look like - but it’s likely not going to be a vintage year. Companies will probably try to hold off on a sale until market conditions improve. Good companies will still get good valuations regardless.

Why does this matter to you? The 2022 numbers show there is a real appetite to acquire high-growth MadTech businesses. PE has become a significant buyer, accounting for $1.6 billion of deal activity in 2022.

There is a clearer path now for MadTech startups outside the US to achieve significant outcomes.

FPC is building relationships with Corp Dev teams and PE buyers. We aim to help our portfolio companies through the whole process.

That European MadTech deal graphic in full:

A Few Thoughts On That Google DOJ Case

Oh my word, Google has been very naughty. This week the DOJ laid out a damning case against Google’s monopolistic activities in ad tech - including collusion, market manipulation and a bunch of other alleged misdemeanors.

It’s not a pretty read (mostly for Google). But let’s not kid ourselves either, we all knew this was going on. It was just difficult to prove it.

Everyone piled into this DOJ story. Jeff Green wrote a wonderful told-you-so op-ed on the TTD’s newsletter, The Current.

Jason Kint gave us a beautifully biased summary of the charges against Google in a sprawling Twitter thread.

It’s an epic breakdown by Jason, and as ever his tussle with trolls in the comments is very entertaining.

Will Google cut a deal with the DOJ and EU, offering to spin out GDN or its sell-side business? At this stage it would appear to be a likely outcome.

Google is in a proper bind here - and FPC is not sure how it escapes without some kind of divestiture.

Ultimately FPC really doesn't care what happens to Google. Our portfolio is perfectly happy with the status quo, and can work with Google across the media and marketing ecosystem. Future outcomes for our fund and portfolio are NOT dependent on Google’s goodwill or “benevolent” rule.

Nevertheless, a Google break-up would be transformational for ad tech, unleashing huge value for tech vendors across the industry.

What happens if Google did offer up a sacrificial lamb - like its sell-side business (GAM, Adx, Admob and GDN)?

Here are a few thoughts on what the first order and second order effects might be if Google did a sell-side break-up:

Value creation on the sell-side would be significant. Publicly-listed SSPs would see a spike in valuation. The ad server market would be re-born, opening up a wave of M&A as companies look to pick off that 94% GAM market share.

Publishers would see an immediate rise in revenue, as Google pushes its demand into publishers via third parties - and not through its own black box end-to-end stack.

Google doesn’t open access to its O&O inventory, specifically YouTube. This is what really matters to Google execs.

The 3rd party cookie in Chrome goes away - with immediate effect. It’s a privacy nightmare. Google wants it gone. By spinning out the sell-side ad tech business, it would no longer be obliged to find a replacement - regardless of what the CMA is demanding.

Third party ad tech might be “strategic” for Google but it’s a low growth business unit for a $1 trillion dollar company. Google can refocus on core products like Search, YouTube etc that yield chunkier margins.

And that’s it for this week, readers. Have an excellent weekend.