We Are All Now AI, Not Ad Tech (Allegedly); Another Ad Net Is Born; StackAdapt’s Quiet Ascent

We Are All Now AI, Not Ad Tech (Allegedly)

AI is everywhere in the media. You can’t read a newsletter, listen to a podcast or consume any tech trade news without encountering a barrage of AI noise.

Insane fundraises by undifferentiated tech startups grab the headlines. Pundits and analysts endlessly celebrate and dissect Sam Altman's quasi-messianic bleating from his Silicon Valley pulpit. Faltering legacy companies - looking to push tenuous AI PR - clamour to appear on CNBC and Bloomberg to grow their investor base and pump the share price. It’s relentless.

It’s hard to discern the sales bullshit from reality at the minute. For the record, FPC is not throwing shade on the technology and its potential impact; the unabated media hype is causing concern, particularly around capital allocation. More solutions like Deep Seek will test the moats of over-capitalised companies like OpenAI. Open source is the future inevitably.

Ad tech is not immune from the hype, either. Magic show presentations by DSPs, standalone ‘AI” startups (that should really be ad nets), and inane LinkedIn hot takes all contribute to the wave of nonsense permeating the industry.

From a macro level, Gen AI is undoubtedly changing habits, particularly around search, which will have knock-on effects for ad tech. A collapse in referral traffic could have long-term effects, such as a more concentrated open web focused on premium sites. This will take time to ripple through.

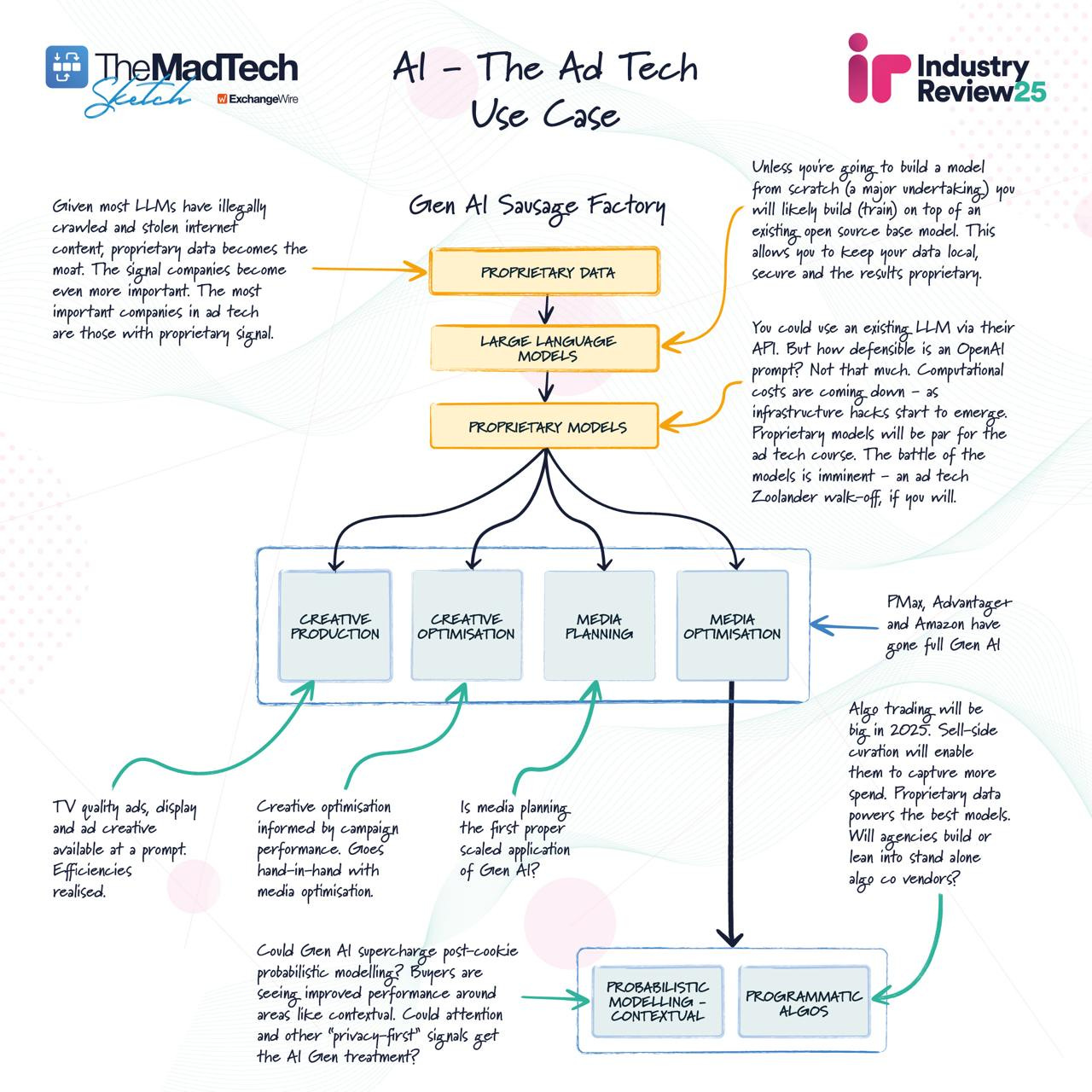

Immediate impacts are likely in areas like creative production and media optimisation, which will wreak havoc on the agency FTE model.

In ad tech, Meta, Google, and Amazon use AI across the entire stack. PMax is the poster child for the “AI advertising revolution.”

ExchangeWire produced a handy sketch of how AI might immediately affect the independent ad tech space in its Industry Review report - https://www.exchangewire.com/industry-review/exchangewire-industry-review-2025/. The sketch is attached below.

The Chinese have proven that the cost of creating a proprietary model is decreasing. Will big agencies want their O&O trading models for principal-based buying? Will ad tech companies need their own to stay competitive? Will there be a lot of M&A in this area? The answer to all of those questions is a definitive yes.

Could we also be witnessing the end of human programmatic trading and ops? What if Pmax is the blueprint going forward? Automated plans. Automated trading. Outcomes guaranteed. It all sounds so wonderful.

As bespoke algorithms for programmatic trading proliferate, proprietary signals will become the most crucial commodity (that's been the FPC view for some time now).

FPC portfolio companies like Lumen and Wult with unique signals will become even more critical for the SSAs (Super Signal Aggregators) as they look to train algorithms and deliver client outcomes. This is the direction of ad tech right now - and feeds into our signal versus media thesis (link here).

AI will undoubtedly have a massive impact, but take a step back and remember what we REALLY do in ad tech: we build mouse traps.

We will happily join the industry bandwagon if AI can help us create better mouse traps. And if that helps pump up the price startups are sold for, even better. Ultimately, this benefits FPC portfolio companies, our fund, and our LPs.

Our advice: embrace this technological shift with fervour, but be wary of the excessive froth. And remember readers, it's still OK to call yourself ad tech.

A New Ad Net Is Born

We love ad networks. They are the greatest business model of all time. They pop up in the areas you least expected and ultimately thrive as viable media channels for ad spend.

This week Coinbase, the leading crypto exchange, acquired Spindl, an attribution layer for the web3 environment.

Kevin Flood, our resident crypto expert, goes into more detail on this week’s pod about why he thinks Coinbase will launch an ad net off the back of this Spindl acquisition.

You can listen to the full episode here: https://newsletter.firstpartycapital.com/p/episode-9-tvscientific-closes-a-25m

Some of Kevin’s thinking is summarised below:

Wallet IDs are persistent, and you can run attribution in web3 to prove the efficacy of advertising

Coinbase is launching an ad net and will use Spindl for measurement purposes

Coinbase enables crypto cos to advertise on its exchange and across Web3.

Coinbase will need boring ad tech infrastructure for ad serving, creative, optimisation and programmatic buying.

FPC has the best toys in ad tech - and our picks and shovel companies power ad nets. More ad nets mean more new business and, ultimately, more exits.

Coinbase will build the best Web3 ad net business ever, and our companies will help power them.

When you think nothing new can happen in this space, another massive opportunity comes along - and right now, they are literally appearing every week.

There is always money to be made in this industry. What a time to invest.

The Quiet Ascent Of StackAdapt

Like most, FPC was blown away by the StackAdapt news this week. The company announced a USD 235MM investment led by Teachers’ Venture Growth.

You can read the story here: https://www.businesswire.com/news/home/20250203806442/en/StackAdapt-Secures-235M-USD-Investment-Led-by-Teachers%E2%80%99-Venture-Growth.

This was likely a secondary, allowing existing shareholders and staff to take money off the table. The company is now worth $2.5 billion.

StackAdapt has focused on the mid-to-long tail agency cohort. It competes with TTD and Yahoo, but despite these outsized competitors, it has thrived.

It is doing nearly $500 million in annual revenue and will likely go public next year.

This is a remarkable ad tech success story from - wait for it - a Canadian company. To survive and be so successful in such a competitive area of ad tech - namely, the DSP market - is a testament to the StackAdapt tech, market strategy and the team.

It’s also another screaming validation of the unrealised potential in our sector.

Sometimes, FPC loses patience with people suffering from (deliberate) myopia regarding the embarrassingly obvious investment opportunities in ad tech. Ad tech powers a trillion-dollar industry, and new business opportunities, media verticals, technology shifts and ad networks (obviously) appear daily.

We will launch FPC Fund 2 very soon. It will be bigger and more ambitious, pushing the boundaries of ad tech investment. More news will follow in the coming weeks and months.

It’s never been a better time to be in ad tech, funding companies and attacking big problems.

On that cheery, optimistic note, we will finish it there. Have an excellent ad tech day.