Why The IAS Deal Is Great For Ad Tech; OOH Going To $100 Billion; & World-Class M&A Pod Chat

Before we jump into this edition of the newsletter, we are hosting a networking event during Ad Week New York. The event will take place at Tír na nÓg on Thursday, October 09. You can sign up here: https://www.eventbrite.co.uk/e/firstpartycapital-nyc-happy-hour-tickets-1581824482609?aff=oddtdtcreator. Space is limited, so be sure to sign up today.

Why The IAS Deal Is Great For Ad Tech

Novacap announced this week that it is taking IAS, the publicly listed SSA (Super Signal Aggregator), private for $1.9 billion. Novacap is a Canadian-based PE firm with $8 billion AUM, focusing on mid-market deals.

The PE firm likes ad tech, having invested in CTV solutions like Cadent and Ad Theorent (a possible home for Publica, perhaps) . Novacap spent the guts of a billion on both of those deals.

So what’s next for IAS? Overall, this was a smart move. The quarterly grind of being a public company was weighing on IAS’s potential.

The stock has been hammered over the past few years, and undoubtedly, the short-termism of Wall Street was strangling long-term strategic objectives.

Going private enables IAS to become the leading SSA (Super Signal Aggregator) and move beyond vanilla ad verification and brand safety.

What would be on the IAS shopping list? It probably needs to acquire more signal-focused companies (ahem), a custom algorithm solution, and a measurement layer, not necessarily in that order. The SSA stack is never complete, so this list is likely to have many more items.

From a purely selfish point of view, FirstPartyCapital is delighted to see this happen. We have the weaponry SSAs need to survive and thrive. It would be great to see more proactive and forward-looking M&A in the space.

IAS, as a private company, now has the time and resources to develop this end-to-end SSA solution.

OOH To Go To $100 Billion By End Of Decade

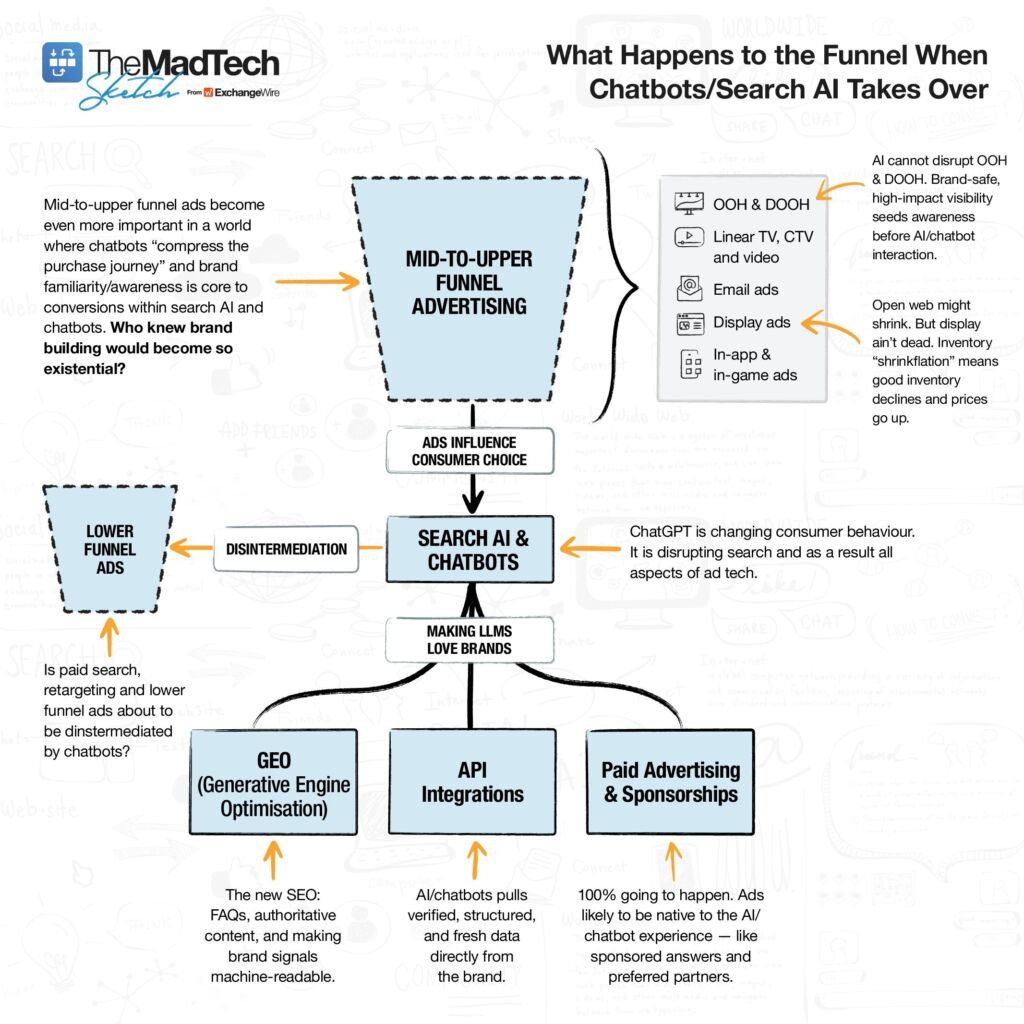

A few weeks back, ExchangeWire’s CEO, Rachel Smith, presented a MadTech Sketch (see below) to over 650 attendees as part of her excellent ATS London/MadTechMoney preamble, putting forward a compelling thesis that mid-to-upper funnel advertising will be in the ascendancy in the age of disruptive search AI and chatbots.

The link to the MTS can be found here: https://www.exchangewire.com/blog/2025/09/24/what-happens-to-the-funnel-when-ai-takes-over/.

The argument is based on the assumption that the marketing funnel could contract as people move directly to chatbots to seek out specific information, thereby avoiding traditional search ads, retargeting, and lower-funnel advertising in the process.

Mid-to-upper funnel ads become even more critical in a world where chatbots “compress the purchase journey” and brand awareness is core to conversions within search AI and chatbots.

The idea that humans initiate the prompt underlies the importance of the mid-to-upper funnel. One of the key channels going forward will be OOH.

The global OOH ad market is 40 to 50 billion dollars. Given the enormous changes to consumer behaviour being driven by AI search, you could make the case for a $100 billion OOH ad market by the end of the decade.

You might well be choking on your bowl of Frosties after reading that last statement. Fair, but let’s consider the following: AI will disrupt a lot of the ad tech ecosystem, specifically the lower funnel, where the ground is shifting aggressively.

DOOH/OOH inventory is fixed, brand-safe and will seed the necessary brand awareness before any individual moves to a prompt.

FPC will be making several bets in the DOOH space. And not primarily because of AI.

There is so much room for innovation around signal, platforms and measurement. And let’s not forget the tasty M&A deals in the space over the past 18 months.

As a standalone category, OOH/DOOH is ripe for even more investment. As a hedge (critical for Fund 2 and our LPs) against AI mania, chaos and disruption, it is a no-brainer.

Lots Of M&A Chat On The Pod

The FPC Podcast returns this week with an M&A focused episode. You can listen to the full episode here:

We discussed the big Deep Intent deal and the opportunity in the area of pharma marketing. We are incubating a business built for the non-US market.

The discussion then moved to Bending Spoons, the Italian company that’s quietly aggregating a bunch of impressive tech assets. The company just recently acquired Vimeo, an undervalued video streaming platform, for $1.38 billion.

Bending Spoons just announced a €500 million debt deal, and indicated more deals are coming. It is reported to be considering an IPO in 2026 with a potential valuation of over $5 billion.

It has a strong subscription story. But given the first-party assets and O&O ad inventory at its disposal, it’s going to need an ad strategy for Wall Street. The pod discusses this in detail and even offers to put the plan together for Bending Spoons. Stay tuned on that one.

Until the next edition, readers. Have a great ad tech day.