Bedrock Platform Powers The Ad Tech Middle; Matt Bennathan Powers Lumen Research Commercials; And Euro Ad Tech M&A Powers Through $11 Billion

Welcome to another POWER-filled edition of The FPC Newsletter, your weekly dose of (un)biased takes on the industry. The conflict of interest rating, as always, is relatively high. But then we have the best startups in ad tech, so why not celebrate it? As Willie Nelson once crooned, “Oh Lord, it’s so hard to be humble.”

Anyway, with tongue firmly in cheek, let’s get on with the week's most important news.

Bedrock Platform Powers The Ad Tech Middle - So Get Investing

Last week, we launched the Bedrock Platform syndicate deal on the FPC portal.

The deal, which includes a video interview with Bedrock Platform CEO Shane Shevlin, can be accessed here: https://investors.firstpartycapital.com/deal/detail/8b6b6515-ff7c-4c86-840a-460612a02e6d.

We outlined seven reasons to invest in Bedrock Platform, an extensive overview of one of our best prospects' exceptionalism. You can read our thesis on Bedrock in detail here: https://newsletter.firstpartycapital.com/p/bedrock-platform-fund-raise-dv-invests.

To save you time and save you a visit to ChatGPT, FPC has summarised them into seven snappy hot takes (see below).

Bedrock Platform is the future of buy-side infrastructure. It powers the “ad tech middle”.

Bedrock is attacking bloated ad tech margins.

It is the buy-side curation platform (its closed-loop curation solution reduces friction, improves performance, and slashes ad tech taxes).

The go-to platform for sell-side curation activation (cost-effective and PMP deals that work).

World-class ad tech team (IPONWEB, Freewheel, Google, Doubleclick alumni).

The FirstPartyCapital network effect (portfolio companies already partner with Bedrock, and a chunk will be customers).

This £400K round has SEIS/EIS eligibility. Tax rebates for UK investors.

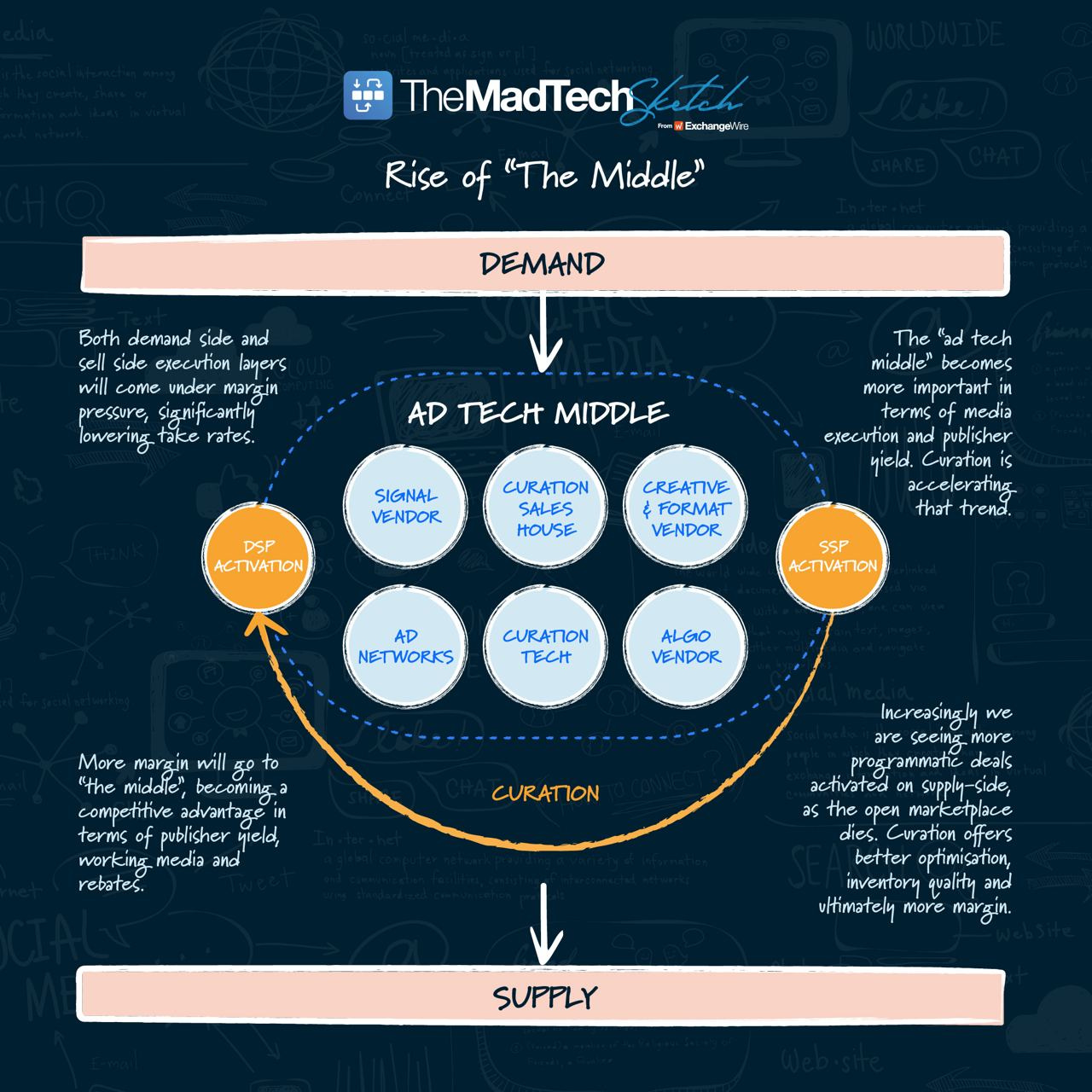

Let’s expand on the first point - specifically the idea about POWERING the “ad tech middle” (see graphic below, courtesy of ExchangeWire).

We at FPC believe a trend has been emerging for some time: the companies in the middle will be the innovation engine of ad tech and, as such, should take more of the value going forward.

Programmatic take rate compression is inevitable, and the emergence of curation is only accelerating this trend.

However, the “ad tech middle” will still need infrastructure to activate data and execute media campaigns across a ridiculously fragmented, privacy-first media landscape.

Very few (if any) scaled buy-side ad tech companies are building for “the middle”.

Who is developing for privacy-first signal (not 3rd party cookie hackery) and the raft of new standards that will define the ecosystem?

Who is innovating around the economics of ad tech?

Who is building the necessary infrastructure for the PSVs (Proprietary Signal Vendors), algo trading vendors, and the wave of curation solutions coming to the market?

Yes, Bedrock Platform, of course.

We are hosting a live Q&A with Bedrock CEO Shane Shevlin and the team. You can sign up here: https://lu.ma/3pjlyjd9.

If that wasn’t enough buy-side infrastructure chat for you, Shane is also on The FPC Podcast this week.

There is not much more FPC can say about Bedrock Platform - except that it’s easily the most strategically important company in our portfolio.

In short, readers get investing.

Lumen Hires Matt Bennathan As CCO

Lumen is the leading global attention solution; big brands, agencies and platforms use its first-party attention for measurement and targeting at scale.

Attention is the ultimate signal in the privacy-first world - and Lumen continues to lead the way.

The company announced this week that it is hiring Matt Bennathan as CCO to continue this big MO.

Matt is an LP in FirstPartyCapital and has a stellar track record of building and scaling sales operations at some of the biggest names in ad tech.

Matt is joining Lumen as the company looks to up the ante in its growth trajectory. Lumen is already smashing its targets for the year, and Matt’s arrival will only help accelerate this growth.

You can read the story in full here: https://www.research-live.com/article/news/lumen-appoints-chief-commercial-officer/id/5137903.

Lumen is ad tech's most valuable PSV (Proprietary Signal Vendor). Its first-party attention signal is already powering many of the biggest ad tech companies.

As the market consolidates into several scaled SSAs, many of them will look to buy PSVs.

You can’t live off the same Sincera data (only available from TTD until July - if you believe the rumours) that everyone else can access or use AI to build finger-in-the-air assumptions around post-campaign data. Eventually, you will get found out.

To differentiate yourself from the inevitable commodity, you need ground-truth data, something proprietary.

The algorithms must be trained, and prop data is ultimately the competitive moat.

FPC has sketched out a rough visual explaining why PSV acquisitions are inevitable. In this instance, we have used Lumen as the PSV that every SSA should be looking to buy.

The arrival of Matt is a sign the Lumen is moving through the gears. Exciting times ahead.

$11 Billion & Counting In European M&A Deals

FPC has been tracking ad tech M&A deals in Europe since May 2021. The recent $150 million Infosum deal pushed us through the $11 billion mark.

It’s worth noting that this probably dwarfs the US haul, but regardless, it’s an impressive return for a sector that is so BADLY under-served by investors.

That's why FPC exists. We are the smart money, fuelling the growth of future ad tech champions in the region - and there are many.

We are tracking just under a billion European ad tech exits this year alone, and we are only in April.

Below is a breakdown of that $11 billion number. FYI, we will launch Fund 2 in the next few weeks. What a glorious time to invest in this ridiculously overlooked vertical.

Have a great weekend, readers.